osceola county property tax payment

With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay. OSCEOLA COUNTY TAX COLLECTOR PHONE.

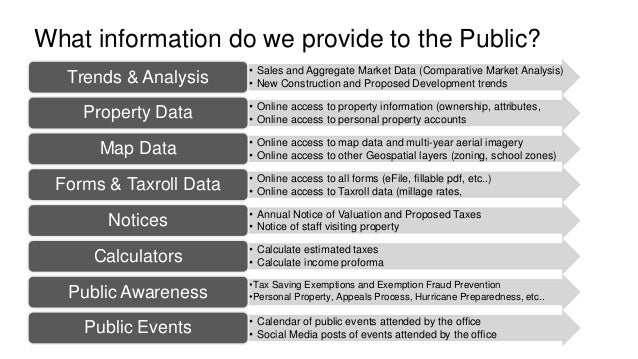

Osceola County Property Appraiser S Public Outreach Program

Make Payment Getting Started.

. Your account number is your parcel number that. Tax Deed sales are held online through the Clerk of Courts website. Tax Online Payment Service Osceola County Step 1.

Please contact the Collector office at 704 920-2119 to get your plan for payments. Property taxes may be paid in semi-annual installments due September and March. Osceola County Step 1.

If you have not received your first notice by June 15 contact your county tax collectors office. Osceola County collects on average 095 of a propertys. Osceola NOTICE TO TAX SALE.

Search Use the search critera below to begin searching for your record. The easiest way to file your tourist tax returns online. Renew Vehicle Registration Search and Pay Property Tax Search and.

407-742-3995 Driver License Tag FAX. Third property tax installment program payment due December 31st. Osceola County Courthouse 300 7th Street Sibley Iowa.

407-742-4037 Property Taxes FAX. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. You can talk to a live agent to pay with eCheck credit or debit card.

Select Record Step 3. Property taxes in Miami-Dade County are among the highest in Florida with an average of 275600. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get.

You can also make full or. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get. Upton Reed City MI 49677 231 832-6107 Office Hours.

Welcome to the Delinquent Tax. The tax collector will mail your first notice of payment due with instructions. 407-742-4009 Local BusinessTourist Tax.

407-742-3995 Driver License Tag FAX. Registration and renewal of trucks over 5000 pounds truck tractors semi-trailers buses or vans carrying. OSCEOLA COUNTY TAX COLLECTOR PHONE.

407-742-4037 Property Taxes FAX. Search all services we offer. The Amount Payable Online represents all taxes that are payable online for each.

Search and Pay Property Tax. Enjoy online payment options for your convenience. If you are unable to pay your tax in full then you can make partial payments.

Search Use the search critera below to begin searching for your record. Taxpayers can call Personal Teller at 877-495-2729. 407-742-4009 Local BusinessTourist Tax.

Select Record Step 3. Welcome to Osceola County Iowa. In Osceola County Florida the median property tax for a home worth 199200 is 1887.

If you are contemplating. Make Payment Getting Started.

Home Osceola County Bs A Online

County Kissimmee Millage Rates Unchanged Osceola News Gazette

Campbell City Tax Collector Civic Architect Design The Lunz Group

How To Get To Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf In Orlando By Bus

Osceola County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Osceola Government Center Kissimmee Fl

Fillable Online Office Of Bruce Vickers Osceola County Tax Collector P O Box Fax Email Print Pdffiller

Home Osceola County Bs A Online

How Healthy Is Osceola County Florida Us News Healthiest Communities

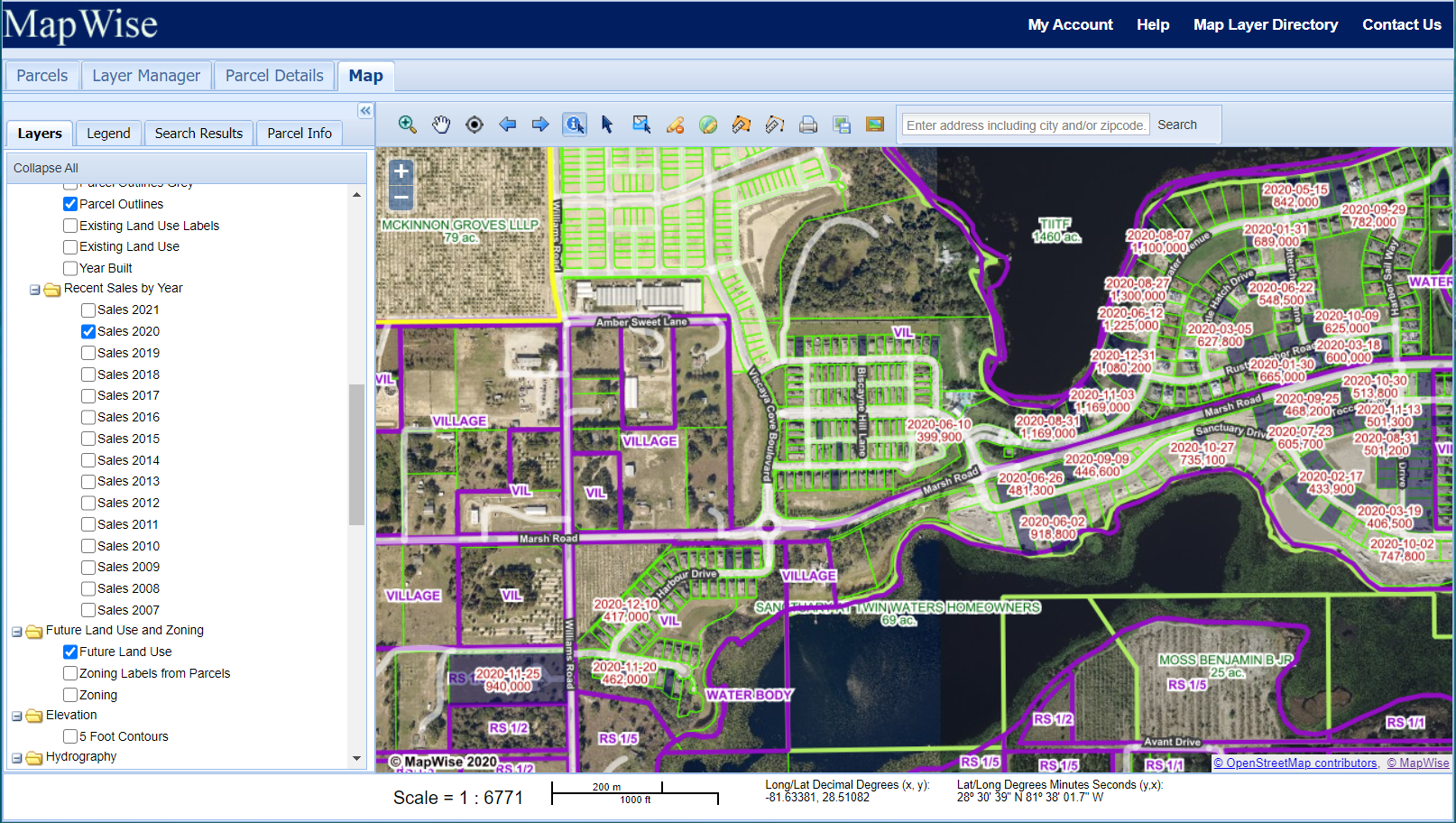

Florida County Property Appraiser Search Parcel Maps And Data

Housing Osceola Council On Aging

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

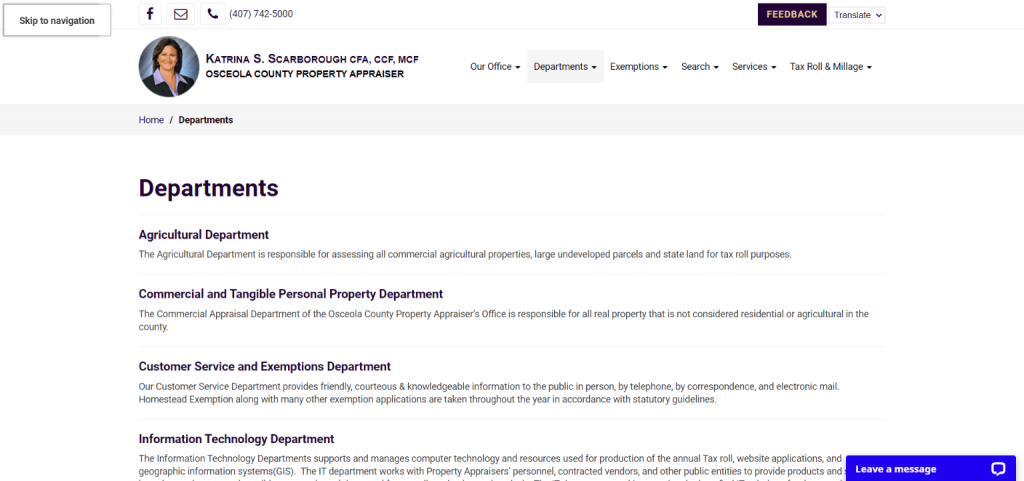

Osceola County Property Appraiser How To Check Your Property S Value